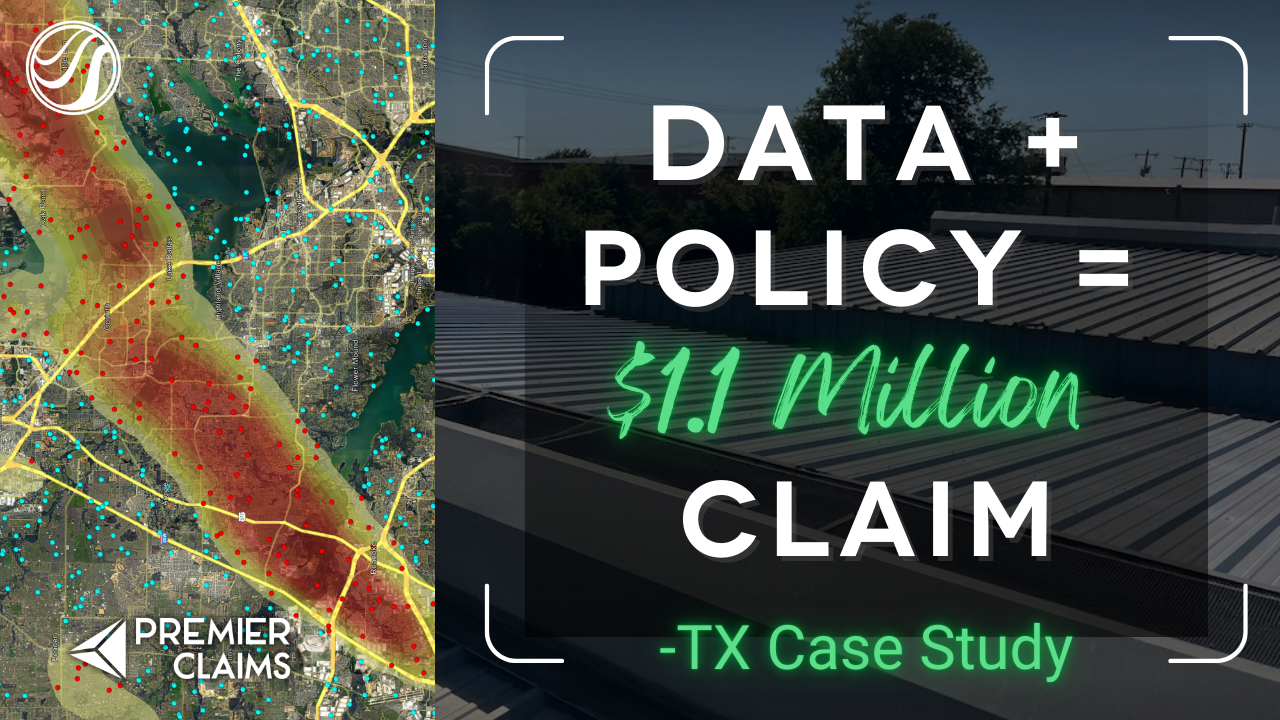

How HailTrace Data & Policy Review Secured a $1.1M Hail Damage Settlement in Texas

Denied at first, won in the end. When a Texas property owner’s hail damage claim was challenged, Premier Claims and HailTrace worked together to validate the storm, review the policy, and negotiate a $1.1M recovery.

Filing a hail damage claim in Texas can be complicated—especially for commercial property owners facing policy exclusions and strict insurance requirements. One of the most common pitfalls? Using the wrong date of loss. An incorrect storm date can lead to denied claims, reduced payouts, or settlements limited to cosmetic damage only.

That’s where accurate hail verification data makes all the difference. In this case study from our partner, Premier Claims, HailTrace storm reports helped verify the true cause of loss and secure a $1.1 million settlement for an industrial property owner in Mansfield, TX.

By combining a detailed policy review with historical hail storm damage reports, the claims team proved the damage was functional—not cosmetic—and negotiated a full roof replacement across three commercial buildings.

This success story shows how storm verification data and policy expertise can work together to turn a complex hail damage insurance claim into a fair and timely settlement.

The Challenge: Cosmetic Exclusions and the Wrong Date of Loss

After a heavy storm season, the property owner, who held three large industrial buildings, was advised by their contractor to file a claim using a recent storm date—July 11, 2023. Recognizing the potential challenges posed by the policy terms, the contractor recommended their client get a third-party review of the insurance policy to better understand what coverage and deductibles would apply.

During the initial policy review, Premier Claims identified two critical issues:

- The policy included a cosmetic damage exclusion, which could be grounds for denial if the carrier believed the damage was superficial.

- It carried a 2% deductible for hail and wind, which significantly impacted the net payout.

More importantly, during their review, they noticed the property owner was moving forward with a claim using July 11 as the date of loss. However, the damage being reported was significantly more severe and did not align with the 1–1.5 inch hail recorded on that date. They quickly advised the owner to pause any further action on the claim with the July 11 date of loss, as proceeding could result in the claim being denied as cosmetic or pre-existing damage.

Instead, they moved forward leveraging HailTrace.

The Solution: Leveraging HailTrace Historical Data

To verify the true cause of loss, the Premier Claims team turned to HailTrace, a weather forensics platform that delivers precise, date-stamped storm data.

Through HailTrace reports and historical records, they discovered that:

- A stronger storm occurred on June 12, 2023, producing hail over 3.5 inches in diameter.

- The insured properties were located in the storm’s core impact zone, confirming the conditions necessary to cause functional damage.

This insight allowed Premier Claims to accurately align the damage timeline. By combining the storm data with detailed photo and video evidence of the roof, Premier Claims was able to present a clear picture of when—and how—the damage actually happened.

The Outcome: A Full Roof Replacement and Fair Settlement

By updating the date of loss, presenting conclusive HailTrace evidence, and ensuring the policy’s exclusions were fully accounted for, Premier Claims built a strong case demonstrating functional, storm-related damage.

The result:

- A $1.1 million settlement covering a full TPO roof replacement for all three buildings.

- Avoidance of denial or partial payment due to incorrect storm attribution.

- Faster negotiation because the evidence was clear and verifiable.

Why Accurate Storm Data Matters in Commercial Claims

Many property owners assume any recent storm can be used as the date of loss. But when it comes to insurance coverage, accuracy is everything.

Using the wrong date of loss can:

- Lead to denials for pre-existing or cosmetic damage.

- Trigger policy exclusions you didn’t expect.

- Delay the settlement process or reduce the payout.

HailTrace technology empowers property owners and their representatives to:

- Pinpoint exactly when damage occurred, using timestamped hail swaths and storm reports.

- Validate claims with independent, third-party data carriers can’t easily dispute.

- Strengthen negotiation leverage by clearly demonstrating functional, storm-related damage—not just cosmetic wear.

- Avoid common pitfalls, such as mismatched timelines, incomplete documentation, or assumptions about storm severity.

This level of precision is often the difference between a denied claim and a fair settlement.

Navigating a property damage claim takes more than one step. Premier Claims stands with you—reviewing your policy, validating your loss, and advocating for a fair outcome. 📝 Get Your Free Claim Review.

And with HailTrace, you’ll have the data to back it up. See unlimited storm maps, history reports, and real-time alerts in action.